feature / sponsored-projects / graphic-design / interaction-design / product-design /

May 24, 2021

By Elisabeth Greenbaum Kasson

CASHING IN: ARTCENTER STUDENTS EXPLORE THE FUTURE OF FINANCE

Though it lacks the name brand recognition of San Diego Comic Con or the South by Southwest Festival, the Digital Document Security Conference (DDS) is an important gathering. The annual event brings together the global secure document community to discuss, among other things, how next-generation technologies—AI, big data, blockchain—can be used to develop new security features for both physical and digital documents.

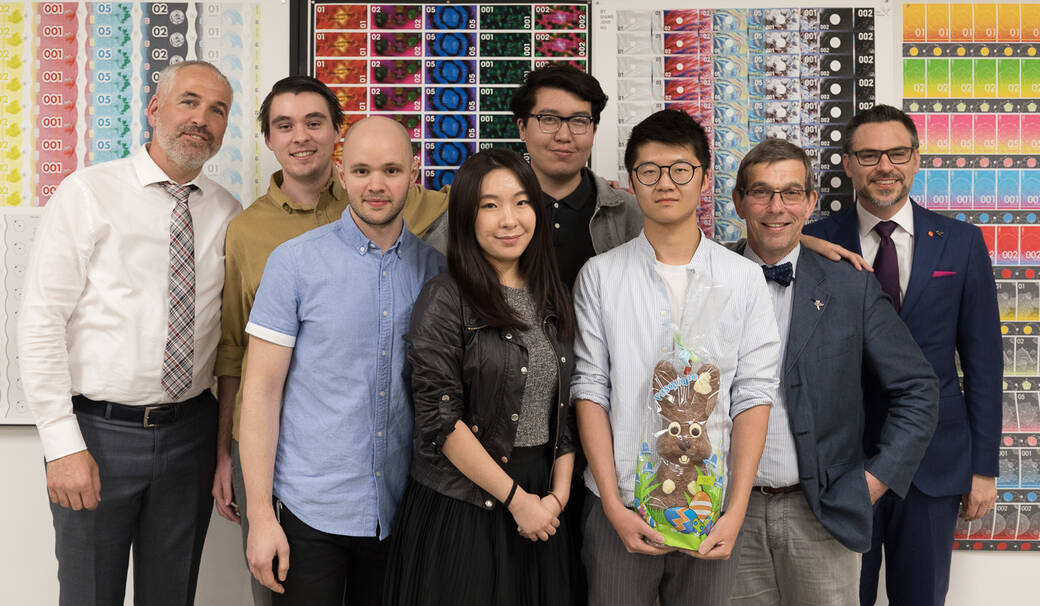

At the recent 2021 conference, Koenig & Bauer Banknote Solutions (formerly KBA-NotaSys) presented a project—one involving NFC tag-embedded banknotes that could be activated and deactivated via a smartphone app—that had been realized in collaboration with ArtCenter students in one of the College’s Sponsored Studios.

One of the oldest financial securities printing companies in the world, Koenig & Bauer is responsible for the printing of more than 95 percent of banknotes, aka cash money, worldwide. They're concerned about the future of banknotes because, while many parts of the world still rely on cash, other parts are becoming increasingly cash-free.

As Koenig & Bauer’s head of banknote innovation and design services, ArtCenter alumnus Hervé Guillerey (BS 99 Product Design) is constantly seeking out new ideas to keep cash users engaged, and oversees research and development for the innovation and design of banknotes. And as part of his quest to maintain banknote relevance, Guillerey has spearheaded two 14-week Sponsored Studios at the College.

During Koenig & Bauer's first ArtCenter sponsored studio foray in 2017, students were tasked with designing a new banknote. "I wanted a series of several banknotes that together, would reveal something to the users," Guillerey said. "The winning project was a beautiful series on space exploration. When you put the banknotes together, you saw the entire solar system. It wasn't anything anyone had ever done before.”

See how our Sponsored Studios bring students and corporate partners together to create innovative solutions.

In 2019, Koenig & Bauer returned with the Banknote Project, whose design brief challenged students to envision what cash could look like in 15–20 years, from both a functional and aesthetic point of view. Students were asked to ideate broad spectrum uses of cash, and to consider how banknotes could incorporate technology, while ensuring it retained its financial value, remained untraceable, and contained security features to prevent its counterfeit.

For this project, the College assembled an interdisciplinary academic team to work with the students to bring Koenig & Bauer’s project brief to life. That team comprised Gerardo Herrera (BFA 89 Graphic Design), a Graphic Design professor who heads up that program’s focus on packaging design; Elise Co, Interaction Design professor with an expertise in wearables and creative technology who has worked with entities like Sony and NASA JPL; and Jeff Higashi (BS 96 Product Design), an associate professor in the Product and Interaction Design programs who has worked with companies like Samsung and X2 Biosystems.

"We have to create new ecosystems for how money can be utilized for different commerce systems," says Herrera, whose experience in fintech over the years made him excited to collaborate with Koenig & Bauer. "There are people in the world who still use cash because its anonymous, and there are others who have no access to the technologies that would allow them to be cash free."

The students, who came from the College’s Product Design, Interaction Design, Illustration and Graphic Design programs, were broken up into different teams that reflected their academic diversity. At the very start of the project, Koenig & Bauer and the students engaged in thought-provoking Q&A sessions to get to the heart of the sponsor's needs and wants.

"Our goal was to help push our students to articulate their ideas in such a way that we can understand and easily envision how they'd be used,” said Herrera. “The students learned from each other by visually and mentally engaging in research that revealed nuances, which further differentiated their products in real world settings."

For the first four weeks of the course, student teams spent time on intensive research and discovery, using everything from the ArtCenter Library's vast trend resources to spending time on the ground engaged in observational research and conducting live interviews.

"I totally geek out on analyzing everyday experiences," said Madison Bucher (BS 20)—a then-upper term Interaction Design student, today a user experience designer at Amazon—who was attracted to the Koenig & Bauer project due to the common everyday interactions involved in using currency. "I wanted to figure out the problem and opportunity areas of currency. Also, I was sucked in when Herve took a deep dive into how people trust that [Koenig & Bauer’s] money is legit."

What particularly interested Bucher and her teammate Sina Grebrodt—a then-exchange student from Design Academy Eindhoven, today an employee at Koenig & Bauer—was why people were no longer carrying cash. They began to analyze the pain points of using cash, noticing that organizing the bills, retrieving them from a wallet to pay and then putting them back in a wallet, were time consuming and unpleasurable experiences. They also considered the lack of security in banknotes. Lose a credit card and it can be easily replaced and its illicit use rectified. Lose your cash and it's gone for good. They wondered if it were possible to create cash with the same security features as a credit card but was also fun to use.

Like the other teams, they brainstormed, and then spent three weeks observing people holding, storing, playing and paying with cash. They filmed themselves handling money, imagined different cash-use scenarios, and designed simple prototypes. During week four of the term, the students presented their initial insights to Koenig & Bauer. They then spent the next three weeks collaborating closely with the sponsor, sharing feedback and exchanging technical information that further honed the ideas they would go forward with.

"What was most interesting was how the students looked at banknotes as a storytelling opportunity,” says Guillerey, adding that the students focused not only on cash and printing cash but embraced a broader view of what payment can become. “All the messaging around consumers is how they no longer have to use cash, but the students were coming up with entirely new ways of interacting with banknotes."

By midterms, the teams were ready to present more advanced prototypes of their projects. Using digital presentations, as well as physical artifacts, they showed their visions of the future of banknotes to Koenig & Bauer representatives, who continued to provide direction, and began to select the ideas that had the most potential to advance during the next seven weeks of the course. By the end of the term, with their concepts fully articulated via presentation decks, PowerPoint and animation, the students presented their final projects to Koenig & Bauer.

Bucher's and Grebrodt's project garnered attention. The duo's goal was to foster a fun, long-term engagement with cash by gamifying the user experience. Users would have control over their physical banknotes from printing through purchase. A money clip with a digital interface would allow them to dispense and track their cash. And they could even be rewarded with augmented reality characters when certain transactions were made.

"It was a great learning experience because of how involved [Koenig & Bauer] was and how open minded they were about hearing our concepts," said Bucher. "Presenting in front of a group of experts in the field, and then getting great feedback was incredible."

Other projects explored entirely different possibilities for banknotes. A more humanistic approach to cash—emphasizing community engagement and charitable giving—were at the heart of one team’s project that utilized cloud computing to automatically funnel money into a cause or need of the user’s choice. Another team focused wholly on security, designing banknotes which could be activated or deactivated depending upon the user's scenario. For example, a lost $20 bill could be deactivated, rendering it void.

Bucher's and Grebrodt's impressed Koenig & Bauer and the sponsor purchased the intellectual property to their project—as well as the IP created by two other student teams—and brought the collective findings back to their stakeholders. Bucher, Grebrodt and one other student were also offered an internship at the company's Swiss headquarters.

"One of the things that really stood out for me, was how the students looked at cash at the beginning of the class to how they ended up thinking about it at the end," noted Guillerey. "In the beginning, they seemed more invested in transactions that were speedy and lacked human interaction, like Apple Pay. I think they became convinced that cash is important but if it's to survive longer for millennial and Gen Z use, it needs to be pushed in another direction. If it isn't, they won't be interested in using it."